HomePage » Ace Financial Examination with Comprehensive API Management

- Author | TPIsoftware

Ace Financial Examination with Comprehensive API Management (APIM)

To ensure sound operations of financial markets, financial institutions are required to pass financial examinations periodically by the authorities. The examination priorities may vary across different countries, but generally the focus areas involve implementation of anti-money laundering, counter-terrorism financing, legal compliance systems, information and communication security management, financial consumer protection, personal data protection, etc.

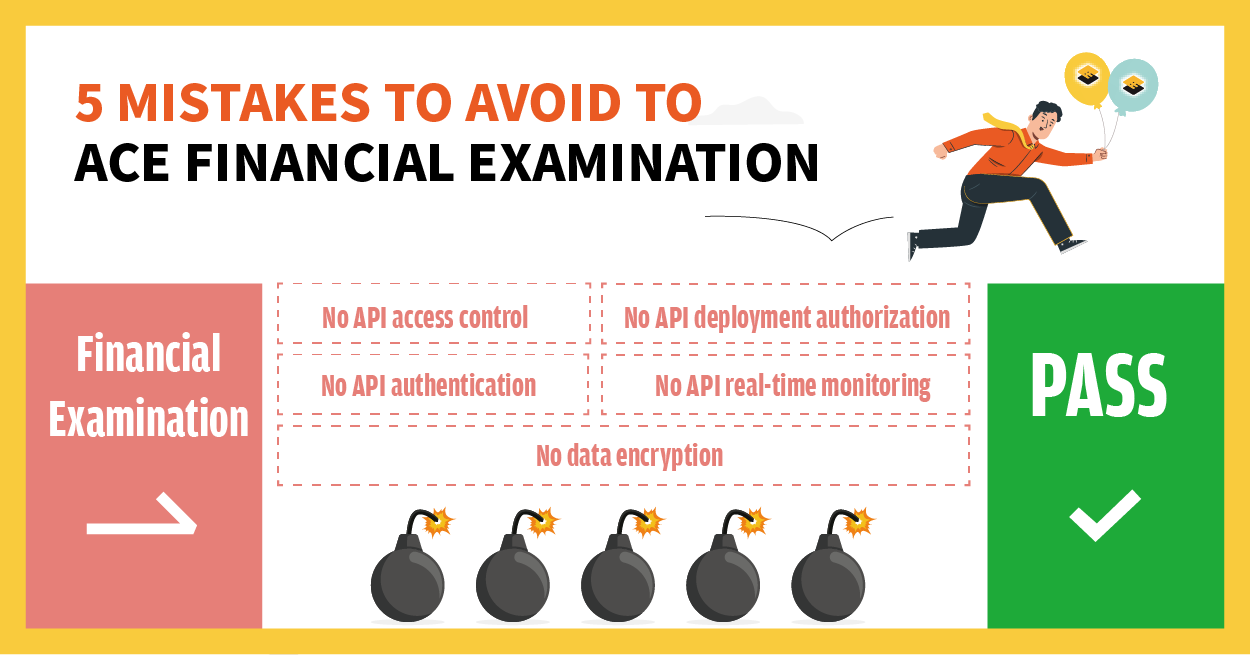

So, what are the things to consider in order to achieve zero-defect financial examination? What does it have to do with API management (APIM) when it comes to financial examination? In fact, the practice of API management has been prevalent across various industries. In response to digitization, the development and adoption of information systems have been growing over the past 20 years, and the use of APIs plays an important role in system managing optimization. The financial sector is no exception. An increasing need for API management has been driven by the trend of online banking, mobile banking and digital-only banks in recent years, which further puts emphasis on financial examination. Here we have collected the five examination priorities related to API management which are most concerned in the financial sector:

Rule 1: API access control with appropriate management procedures

Rule 2: API deployment authorization with assessment principles and risk avoidance

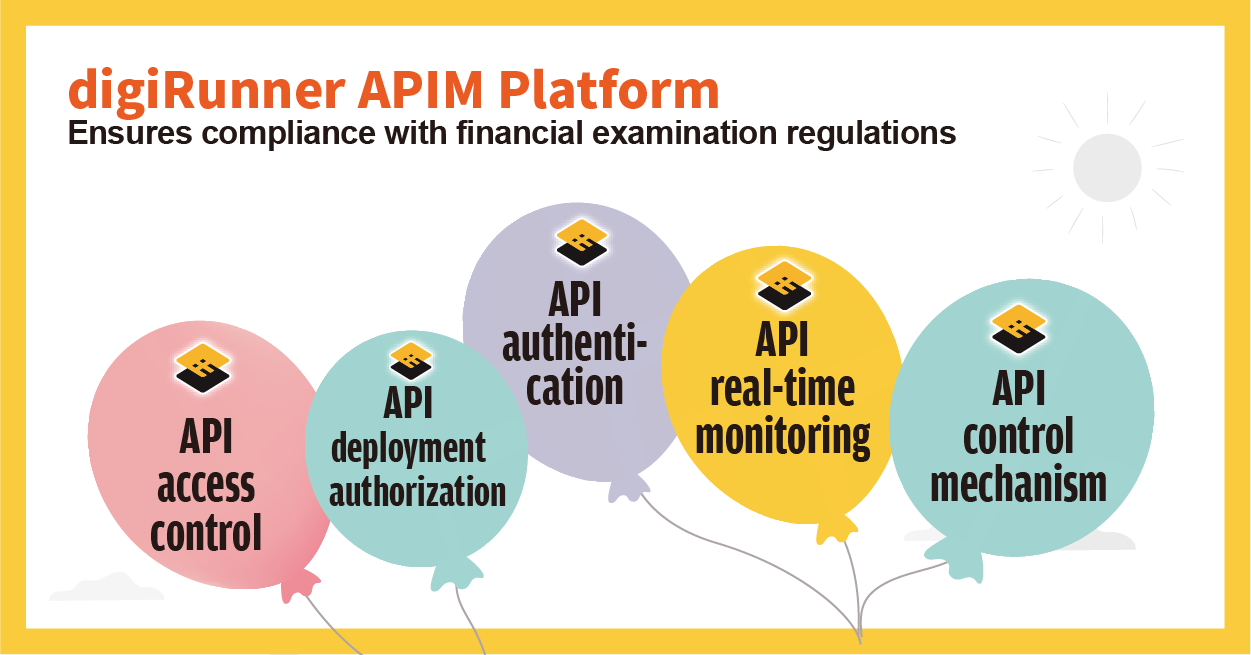

Through API management (APIM) platform, you can configure the access to view APIs, the management of API quotas and traffic, token authentication and encryption, and set API groups with different security levels, facilitating access control of internal and external units. Affiliated units can also manage permissions based on the user roles to ensure the permission levels and procedures of each API in legal compliance.

Rule 3: API authentication and verification

Rule 4: API real-time monitoring of access activities

Rule 5: API control mechanism with data encryption key management

Two Essential Factors To Consider When Choosing API Management (APIM) Platform

We invite you to visit our official page if you want to learn more about the digiRunner API management (APIM) platform. If you are interested in topics regarding API management for financial examination, please fill out the form below to get in touch.